Utilizing Mobile Random Digit Dialing (RDD) Sampling Frames for Population Surveys in low- and middle-income countries in Sub-Sahara Africa

In recent years, mobile telephones have become increasingly prevalent in developing countries, particularly as cell phone ownership in Sub-Saharan Africa has steadily risen. This has led to an increase in the use of mobile surveys as a means of data collection, particularly with RDD sampling.

Random-digit-dialing sampling involves generating random phone numbers and screening them for connectivity in order to provide survey fieldwork organizations have a productive and representative sample for a national survey. This method is predominately used in developing countries where traditional sampling methods, such as Face-to-face may be difficult due to poor infrastructure, traveling to remote rural areas or security concerns and online surveys are not feasible due to low internet penetration and low literacy rates.

In contrast to purchased lists, RDD phone numbers ensure that every potential owner of a mobile device can be sampled rather than a biased or incomplete list from operators which can lead to significant sampling issues.

Mobile surveys offer a number of advantages over traditional survey methods. They are often quicker and cheaper to conduct, as they do not require the same level of logistical planning as traditional surveys. They also have the potential to reach a wider audience, particularly in rural areas where traditional surveys may be difficult to conduct.

However, there are also some challenges associated with mobile surveys in developing countries. One of the main challenges is ensuring that the sample is representative of the population being surveyed. This can be difficult when conducting a household survey, as not everyone has access to a mobile device.

To address this challenge, researchers can use stratified random sampling, which involves dividing the sample population into different groups and then selecting a sample from each group. For example, researchers could divide the telephone-owning sample population among the prefixes of the national mobile providers and stratify the sample by the proportions of their subscriber’s market share.

Another challenge is ensuring that the survey is conducted in a way that is culturally appropriate and sensitive to local customs. This may involve adapting survey questions to native and many tribal languages to ensure that respondents understand the questions being asked.

Despite these challenges, mobile surveys using RDD sampling have the potential to provide valuable insights into a range of issues in developing countries. For example, they can be foremost used to collect data for international program development and evaluation efforts.

Considerations for using mobile phone surveys with RDD sampling approach:

There are key factors to take into consideration when choosing mobile telephone surveying, be it in the form of: Computer Assisted Telephone Interviewing(CATI), Interactive Voice Response(IVR), and SMS: Two way, or Push-to-Web. Among the primary items to look over when surveying a Sub-Sahara African(SSA) country are:

- Telephone coverage and frame size

- Literacy rates and languages

- Mobile network operator coverage among providers

- # of survey respondents that can be reached on the device

- Usage of multiple SIM cards

Telephone coverage and frame size

Key metrics for determining whether a telephone sample frame is sufficient for covering the population are the telephone frame size, subscriber counts(active frame), and the population size of the countries:

- Telephone frame size – the sum of all possible telephone number combinations that can be generated according to the nation’s numbering plan, telephone number length, and available dialing codes and prefixes.

- Subscriber count – represents the populations that can be reached via a telephone number device and/or SIM card.

- Population size – the total count of residents that live in the country.

From these key metrics, we can derive crucial information such as how wide the Active rate(count of subscriptions/telephone frame*100) And the telephone penetration rate (count of subscriptions/population*100) – calculate the number of telephone subscriptions per 100 inhabitants.

Telephone coverage is the count of all inhabitants that have access to at least one mobile device or SIM card.

eg. In South Africa’s case, the metrics are:

Population*: 59,392,255 (2021)

Mobile telephone frame size**: 200,000,000

Subscriber count*: 88,566,977 (2021)

Active Rate: 44% of the frame is active – 44 of 100 random numbers are expected to be working numbers.

Penetration rate: 149% – indicated that inhabitants have access to more than one mobile number device and or sim card – hence they have a larger probability of being over-selected in a random sample. Doesnt have any indication of non-coverage.

*Source: ITU Numbering Plan for South Africa

**Source: World Bank, 2021

One limitation when we have a high penetration rate among subscribers when calculating these metrics is the over-coverage of respondents owning 2 or more cellphone numbers. This may cause duplication and/or overlapping responses. If individuals provide different phone numbers for each survey, it becomes challenging to identify and eliminate duplicate entries. Additionally, multiple phone numbers may indicate a higher level of technology adoption or socioeconomic status, leading to a potential bias in the sample towards individuals with greater access and resources.

Literacy rates and languages

Literacy rates and languages spoken play a crucial role in picking the correct interviewing mode within the telephone sampling frame: For countries with close to 100% literacy rate a text-based interviewing approach utilizing SMS messaging such as two-way SMS questioning and answering and an SMS ‘Push-to-Mobile’ web online survey are cost-effective and convenient method compared to live caller CATI interviews which typically involve a fieldwork facility, field staff, and equipment.

In countries where the literacy rates are lower, a wiser approach would be to use the traditional Live caller CATI interviewer to conduct the interview verbally.

The presence of multiple official and unofficial tribal languages may pose a problem in getting sufficient responses across the whole nation. For example, in South Africa, there are 11 official languages: Afrikaans, Venda, Northern Sotho, English, Southern Sotho, Swati, Zulu, Tswana, Ndebele, Xhosa, and Tsonga. IVR and SMS modes enable respondents to re-route the questionnaire to the desired language at the start of the interview, an option for which CATI interviewing will require interviewers to know more than one language of the most frequently spoken languages. Otherwise, the language barrier would risk non-response from the sampled respondent. On the other hand, there is the case of multiple African countries which all use a major European language as their sole official language, such as the case of Burkina Faso, the Democratic Republic of the Congo, Madagascar, Cameroon, Ivory Coast and Niger which all use the French language.

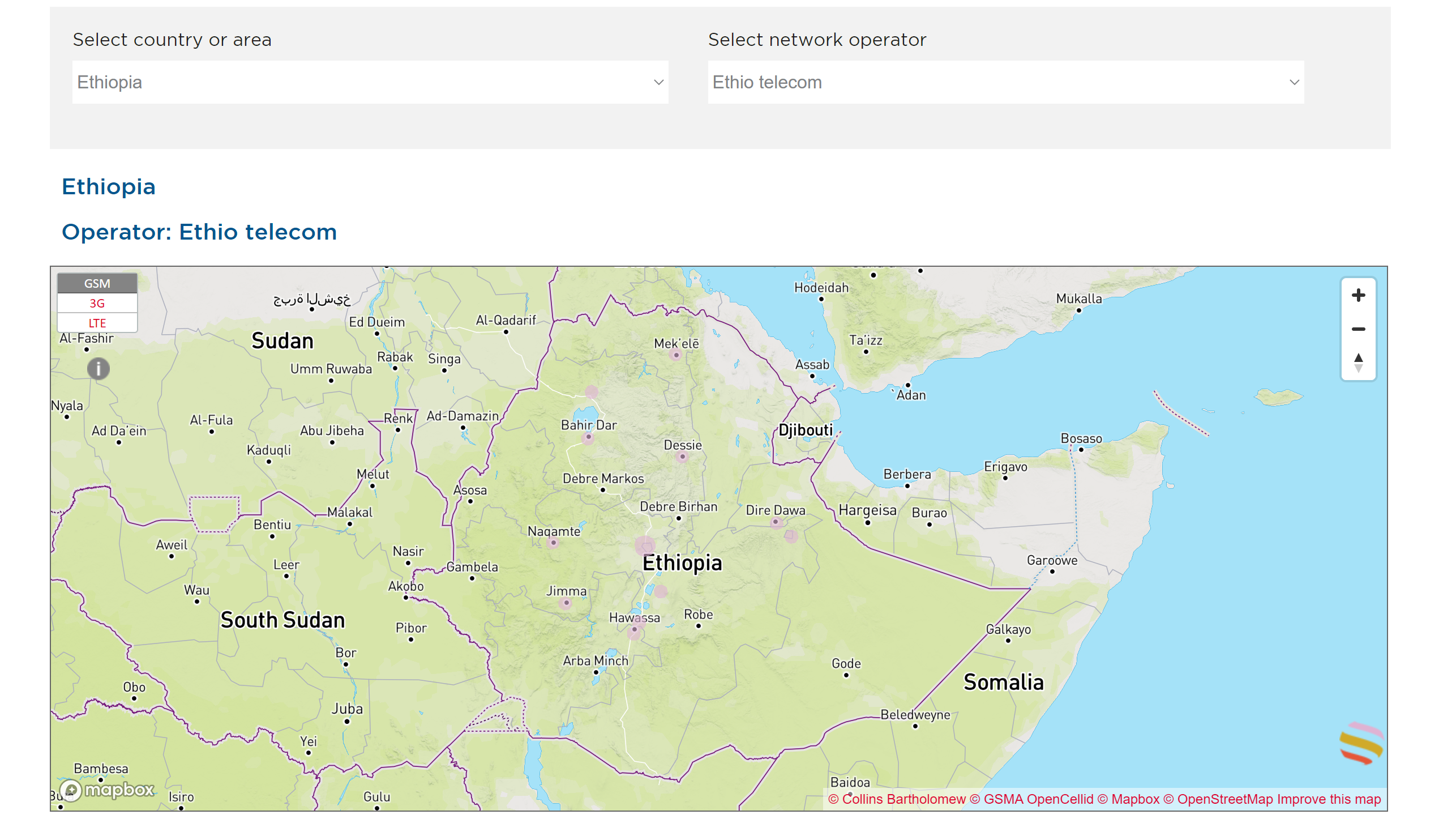

Mobile network operator coverage among providers

As most of the countries in SSA are considered low or middle-income countries with vast geographic spawn, network coverage among mobile services is not equally distributed across the entire geography of the county. Contributing to the undercarriage among certain populations in remotely far areas.

Certain remote areas may be disconnected from network service or the current network may not be permanently stable and would result in regular disconnections or power outages. Increasing decreasing response rates and increasing the disconnected rate of the screened active RDD mobile sample.

GSMA Network Coverage Maps provides a good and up-to-date overview of the geographical span of each country by the provider. Allowing researchers to foresee any possible under-coverages in rural areas or wider regions, and potential overrepresentation among urban areas such as major cities, as in the case of Ethiopia’s single mobile provider (Ethio telecom) coverage.

# of survey respondents that can be reached on the device

As fixed landline devices are poorly adapted across the continent, limiting their use to only urban areas and business establishments. It is safe to say that SSA alongside other developing sub-continents has skipped the era of adoption and usage of fixed telephone use in favor of wireless telephone connection.

As a result of this, in a Household-level it is expected to have mobile devices be the main phone device for more than one person in the dwelling. This poses some challenges when measuring the selection probabilities of the respondents.

One way researchers tackle this obstacle is to include an additional question in the interview asking how many household members have access to the same device, and through that establish better calculations of the selection probability.

Usage of multiple SIM cards

When examining the selection probability, alongside the question of how many people can be reached in the household, researchers have to take into consideration how many telephone numbers can the selected respondent be reached. This is particularly the case for SSA, as respondents are prone to regularly change SIM cards when network access is limited in certain areas or they have run out of pre-paid credit on their current SIM card. This phenomenon also creates shifts in estimating the selection probability as some respondents have a higher probability of being selected than others.

From experience, other survey researchers we had the pleasure to collaborate with, address this issue by asking respondents how many sim cards they can be reached on.

Telephone phone coverage and survey topics:

Top 3 Countries with the Best Cellphone Penetration in SSA:

- South Africa: with a penetration rate of over 80%, South Africa is the leading country in terms of cellphone adoption in SSA.

- Nigeria: with a population of over 200 million people, Nigeria has a penetration rate of over 60%, making it the second-highest.

- Kenya: with a penetration rate of over 50%.

The top 3 Countries with Worst Cellphone Penetration in SSA:

- Eritrea: with a phone penetration rate of only 7%, Eritrea has the lowest cellphone adoption rate in the region.

- Central African Republic: with a population of over 4.7 million people, the Central African Republic has a penetration rate of only 8%.

- Chad: with a population of over 16 million people, Chad has a penetration rate of only 9%.

Sample Solutions has provided sampling in over 44 African countries for surveys that occupy strategic fields for the region such as:

The report showcases mobile phone coverage on the individual level among all nations in the region.

In this section, we will outline the key facts and figures relevant to mobile sampling for all countries in SSA as well as in which programs and evaluation studies our sampling efforts have been implemented.

Our sampling has over the years enabled studies to be conducted using phone interviewing and has played an integral role in study design development for multiple international survey efforts for various fields and by many international organizations and Think Tanks like Pew Research Center, World Bank, Gallup, and other United Nations Agencies, in fields such as:

- Public health: Availability of healthcare, measuring public health risk factors, disease monitoring, and eradication, food security and nutrition

- Education: Monitoring the quality of education and access to resources

- Economic development: Microfinancing, agriculture, and job opportunities

- Infrastructure projects: Access to services such as water and sanitation, development planning for roads, electricity, and telecommunications.

- Gender equality and Women’s rights: Women’s empowerment, access to abortion.

- Rule of Law: Corruption monitoring, Conflict resolution, and Peacekeeping

Advantages and Disadvantages of sampling survey respondents Using RDD for phone survey research in SSA

Advantages of Random Digit Dialing (RDD) sampling for mobile phone surveys

Among the biggest advantages of mobile RDD sampling in the SSA region, we list:

Wide coverage:

The usage of cell phones has become ubiquitous in Africa, providing wide coverage among adult populations. Making it an optimal mode for a nationally representative sample

Cost-effectiveness:

Compared to other traditional survey methods, mobile RDD is cost-effective as it eliminates the need for paper or tablet-based surveys and field workers as in the case of face-to-face surveys.

Convenience:

Mobile RDD survey allows for convenient data collection as respondents can complete the surveys from anywhere at any time.

Faster data collection:

Data collection through mobile RDD is faster compared to traditional survey methods, as it eliminates the need for manual data entry. At the same time, it is also a convenient mode for data collection as respondents can participate in surveys from anywhere at any time.

Disadvantages of Random Digit Dialing (RDD) sampling for mobile phone surveys

Disadvantages to take into consideration for cell phone surveys conducted via RDD sampling and Mobile surveys in the SSA region may include:

Non-coverage:

Populations without access to a mobile device or SIM card may be subject to non-coverage within the telephone frame, which limits the reach of mobile RDD surveys.

Sampling bias:

Cell phone ownership is not evenly distributed across different socioeconomic groups, which may lead to an over-represent of urban, highly educated, and male respondents these audiences are more likely to own mobile phones compared to other counterparts of the populations.

Technical issues:

Technical issues such as poor network connectivity and device compatibility can affect the quality of data collected through mobile RDD.

In conclusion, mobile surveys utilizing RDD offer a promising approach to data collection in developing countries, particularly in SSA. While there are some challenges associated with this method, these can be addressed through careful planning and implementation. With the right approach, mobile surveys have the potential to provide valuable insights into a range of social and economic topics about the region and help inform policy decisions in the nations comprising the region.

Through the utilization of stratified random sampling, we ensure a representative sample as a solution to address the challenge of ensuring sample representativeness. This article will be helpful to researchers who are evaluating appropriate survey methodology and want to field RDD surveys among African nations.

About Sample Solutions

Sample Solutions is a member of the World Association for Public Opinion Research(WAPOR), the organization has presented on numerous occasions related to this topic and provides Dual-frame and single-frame RDD sampling for 170+ countries, including all countries in Africa for live caller Computer Assisted Telephone Interviewing (CATI), SMS, and interactive voice response survey (IVR) survey modes. If you have a research project that may require an RDD phone sampling approach for a specific country, we warmly welcome you to request our complimentary Sampling Methodology Whitepaper and country factsheet from our RDD Sample Coverage Page.