Quantiative CATI interviews

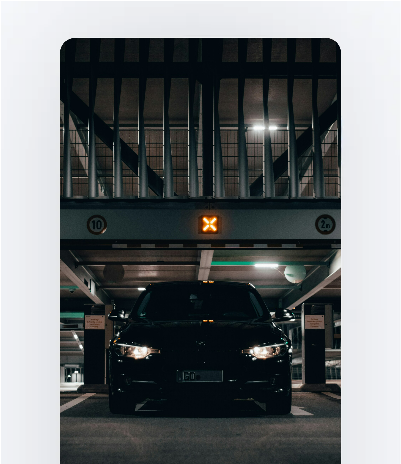

Automotive Study among mid to premium brands In EU5

For this research project, the client wanted to use a representative sample of car owners in Germany, France, UK, Spain and Italy from Audi, VW, Mercedes and BMW for brand comparison.

Project Name

Automotive Brand comparison study

Projects Timeline

Q1 2023

Services

Sample Selection, Big Data Enhancement

Research Type

CATI Sample

Table of Contents

Key Metrics

Different Languages

Fieldwork days

CATI Interviews

1

Project Background

Premium brand owners are only hard to verify from B2C access panel data. Sample Solutions, however, needed to provide a representative sample of premium brand owners of four German car brands in the top 5 European markets to compare brand performance and perception.

2

Project Challenges

A complete random sample for these low incidence rate of ownerships is not possible. Therefore, the sample of B2C respondents had to be overlaid with public data sources from the web, which provide an indicator which car brand someone is likely to have in all of these markets. The client also wanted to have a good spread of the different car segments which needed to be added as sample variable (SUV, compact etc).

3

Solution Provided

Sample Solutions provided a phone sample and push-to-web interface via SMS and Whatsapp. The majority of the interviews were conducted via CATI.

Sample selection, outreach, ai supported messaging as well as the incentive fullfillment were all provided by our in-house technology.

4

Sampling Process

A 4 step sampling strategy was created based on our in-house mobile RDD database that provides access to phone numbers of every person in the target markets.

Afterwards the phone numbers were checked for working status and linked up to various secondary data sources.

As part of the CATI sample, also a push-to-web interface was setup to recruit respodents that might not want to be interviewed via the phone but willing to share their opinion via an online survey.

1

Define Sampling Strategy

Different sampling strategies were discussed on the best way to achieve a high incidence rate.

2

RDD sample Generation

An initial sample has been generated based on a true RDD sample covering all potential numbers that exist in these 5 markets.

3

Big Data Matching

Every generated phone number was linked up to different online services from Google Search as well as special discussion board or automotive related platforms to check for matches.

4

Automotive Profiling

The type of the car in terms of segment as well as brand of the car was added as variable.

5

Sample Verification

All records were re-verified for working status and accurate linkage to ensure a high fieldwork efficiency.

5

Results and Outcomes

The client was able to collect quantitative data with the various quotas, which allowed a better comparison of the brand perception.

From a fieldwork perspective it can be noted that the accuracy of the database was beyond 80%, which allowed an efficient data collection process.

Respondent Recruitment

Recruitment of these very niche audiences is possible by leveraging Big Data applications that provide real authentic respondents which usually cannot be access through online panel providers.

Positive Feedback

Client was extremely satisfied with the diverse range of respondents and feedback provided.

Agile Workflow

From project confirmation to first respondents in - the turnaround time was only 3 working days showcasing the strength of the integrated sampling selection, onomastic profiling and big data matching.

Door-Opener

The project has been a door-open for various other similar projects in the business research space.

6

Conclusions

They approach clearly demonstrates how premium segment drivers can be sampled by mixing offline and online sourcing and leveraging Big Data for improved incidence rates.

A similar approach would be feasible for a qualitative study when it comes to electric cars.